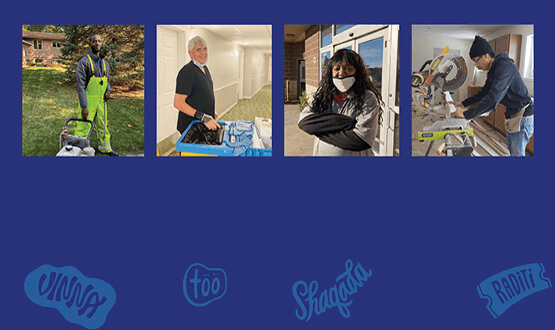

Together, we prepare people for work.

Your donations and purchases help us connect people to jobs every day.

News

Make Everyday Earth Day

Celebrate Earth Day and slow the impact of fast fashion by thrifting with Goodwill. VIPs always shop Earth-friendly…

What Happens with Your Donated Items?

Did you know that it takes 2,000 gallons of water to produce a single pair of new jeans and 1,000 gallons for a new…